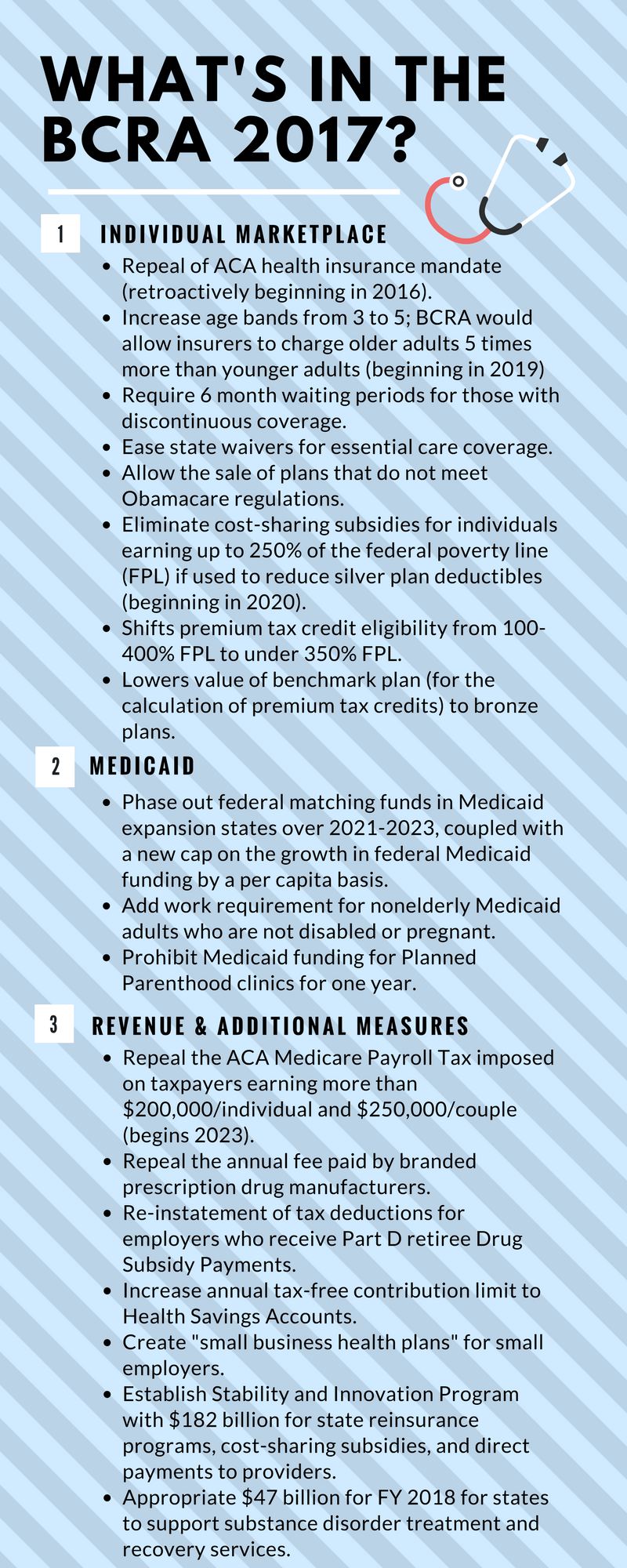

The Better Care Reconciliation Act of 2017 (BCRA), like its House counterpart the American Health Care Act (AHCA), contains several components that rely on stratification of health risk in the insurance markets to lower premium costs for young and healthy Americans. Despite the publicity surrounding the bill, a surance market.

The BCRA largely retains ACA regulations for the individual and small business insurance marketplace (i.e. strict regulation of medical underwriting and no exclusions of insurance based on pre-existing conditions), but includes a key measure for small businesses and self-employed individuals to opt into the large group insurance market, which is far less regulated.

These new health care plans are called “small business health plans” (SBHPs). Like the large group market, SBHPs are exempt from individual marketplace mandates to cover enumerated essential benefits and allow for medical underwriting in formulating premium rates.[i] The Department of Labor certifies whether a business qualifies as a small business. Ostensibly, it will be an organization with fewer than 50 employees, though the bill is not specific. With scanter coverage, SBHP premiums will initially be relatively low compared to plans on the individual marketplace.

Unfortunately, SBHPs hardly make for a sustainable health expenditure solution. SBHPs encourages adverse selection, which could destabilize small business insurance markets and individual insurance markets alike. Theoretically, a small business employer or self-employed individual (in the 14 states that allow self-employed individuals to purchase coverage as a “small group of one”[ii]) could opt for a SBHP when they are relatively healthy and then revert back to a more comprehensive individual marketplace plan once a covered group member becomes sick or injured. The result thereby drives up premiums in the individual marketplace, since the SBHPs are self-selected to exclude low-risk individuals from sharing risk in the larger individual market. There are no regulations in the current draft of the BCRA that addresses these problematic shifts between SBHPs and individual market plans.

Given the general trend for consolidation among health care professionals, there are an increasing number of non-hospital aligned practices, including management service organizations or single-specialty groups, that qualify as small businesses. According to the most recent AMA Physician Practice Benchmark Survey, the majority of physicians work in small practices, with 57.8% working in practices of 10 or fewer physicians. [iii] Furthermore, less than 20% of anesthesiologists count the hospital as being their primary employer. The SBHP rule makes it more likely that small physician groups can purchase health insurance with worse coverage but at lower premiums to lower overhead costs, but due to the imbalance in pooled health risks in the SBHP market, these groups must be prepared for higher premiums for better coverage should they need it. The Ted Cruz Amendment, added to the BCRA draft on July 14th, would likely exacerbate this problem by further loosening medical underwriting regulations.

[i]http://www.kff.org/health-reform/issue-brief/association-health-plans-for-small-groups-and-self-employed-individuals-under-the-better-care-reconciliation-act/

[iii]https://www.ama-assn.org/sites/default/files/media-browser/public/health-policy/PRP-2016-physician-benchmark-survey.pdf